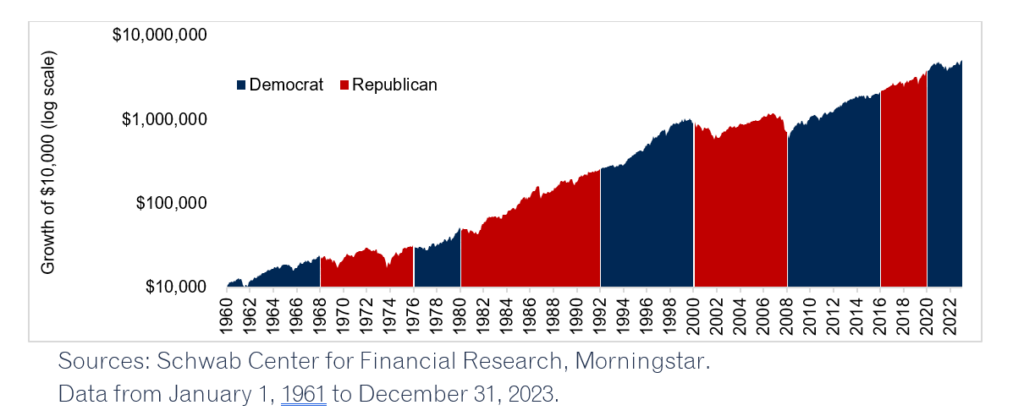

The US Presidential election is just 16 days away. It’s likely that the markets will be influenced not by the outcome of one party versus the other, but rather the clarity of an outcome, which will offer a pivot for investors and the markets to have a sense of the strategic direction that we are headed. Below is a graph showing the growth of a $10,000 investment in the stock market since 1960. Staying invested, regardless of the party administration, has yielded more than 10-fold return on that investment and each president has exited office with the stock market at a higher value than when they entered.

Fed Funds Rate, Money Markets and Soft Landing

The US Federal Reserve started the anticipated rate cutting cycle in September and is expected to implement at least one more .25% cut before the end of 2025. This lower interest rate has a direct impact on the interest earned in money market accounts. Furthermore, as the Fed’s overnight rate has decreased, the longer-term interest rates have risen relatively speaking, indicating a “normalization” rather than inverted yield curve. This shift presents an opportunity for income-seeking investors to extend their bond maturities beyond the short-term to secure higher returns. High-yield bonds offer attractive yields (equity-like returns) as high as 7.5%, while bonds with higher credit ratings can earn 5.2% on the taxable side and a taxable equivalent yield of 5.35% in the tax-free bond market. These higher-yielding bond options look appealing as we rebalance away from cash, which is expected to continue to decrease as short-term rates fall.

The Stock Market Looks to Have Peaked: Where Do We Go from Here?

The stock market appears to be signaling an “all-clear” as we have recently reached new highs for the Dow Jones Industrial Average (YTD 16.6% increase) and the S&P 500 (YTD 24.3% increase). The market recovery over the past two years is encouraging and it reflects the resilience of the US economy and markets. However, it also raises concerns about the future direction of the market.

In the near term, we prefer the higher income-producing returns on real estate investments (particular multi-family housing) and of bonds that look attractive on a risk-adjusted basis compared to stocks. However, we emphasize the importance of maintaining a strategic outlook on your overall portfolio and the long-term benefits of holding stocks even during times of uncertainty like the ones we are currently facing.

The international stock markets have also shown recent strength, with European markets remaining positive for the year so far. The European economy is benefiting from rapidly falling interest rates, as the European Central Bank (ECB) has already implemented three rate cuts in 2024 to stave off a recession while the economy recovers from the pandemic years.

| YTD thru 10/18/2024 | 15 Year Average | |

| US Large Cap | 24.33% | 14.10% |

| US Small Cap | 13.50% | 10.60% |

| International | 10.31% | 6.00% |

| US Bond | 2.98% | 2.60% |

AI – Exciting or Daunting?

Both. Artificial intelligence (AI) has delivered the most market excitement since the internet became omnipresent in everyday life. This emerging technology promises to be useful, but the question remains as to who will be the big winners and losers of this revolution. Chip makers producing the engine behind AI have dominated the headlines thus far, while we are watchful for the industries and industry leaders that will execute best on creating value with AI technology. There is much more to come on this front.

The information presented in this newsletter is the opinion of Alpha Capital Family Office, LLC and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Alpha Capital Family Office, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.