The only constant in life is change. This timeless saying originates from the ancient Greek philosopher Heraclitus, and, no surprise, rings true in 2025. As we look at the year ahead, we can expect more shifts in market conditions and the broader economic landscape. As your investment managers, our goal is to prepare for these changes by making thoughtful, strategic investments.

We cannot ignore the fact that valuations of some of the “Magnificent 7” stocks are reaching all-time highs again in 2025 and have notably retreated with the recent tariff related volatility. In 2024, the growth of just these seven companies contributed to over 50 percent of the growth of the much broader based S&P 500 index. Given that knowledge, combined with the fact that change happens frequently, we create stock portfolios that are diversified and include bespoke positions in several other companies included in the “unmagnificent 493” as well as sectors beyond the tech focused Mag 7. We still favor the US stock market over the international market, and we have tempered our return expectation considering the double-digit market growth over the past two years. Selectivity remains a core principle in our approach.

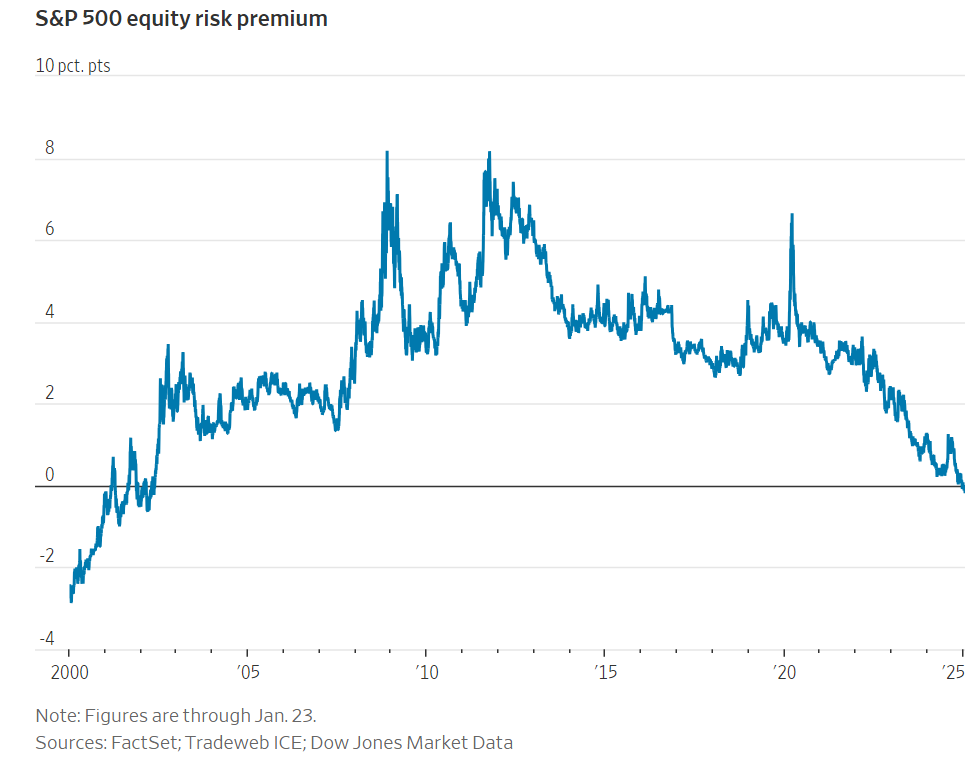

So where do we go from here? High quality bonds present a good opportunity. However, we are not alone to recognize this. Income seeking investors are piling into bond investments. The Federal Reserve has signaled that it will hold off lowering the overnight bank lending rate (Fed Funds Rate) until the summer and correspondingly, interest rates have stayed higher in the short-term and the longer-term. Furthermore, the equity risk premium is the additional amount of return investors expect to receive over risk-free bond investments and this premium is at a 20-year low. Below is a graph showing the equity risk-premium trend since 2000.

We can make high conviction bond investments with solid single digit returns. While that may not dazzle like some of the high-flying stocks, we can count on their consistent income and the security of par value repayment at the bonds’ maturity. These investments provide a dependable cushion and portfolio stability and that suits our strategy well. We can say to the market, go ahead and change, we are ready for you!

In summary, now is not the time to rush into the market. There are no clear “fat patches” of opportunity and overall, the relative risk is heavily influenced by exogenous factors, and the absolute risk is less attractive given current full valuations. We remain mindful of the potential for inflation to accelerate, as tariffs, government policies and fundamental factors are driving this risk upward. Additionally, geopolitical uncertainties continue to add an element of unpredictability to the landscape. When considering allocation, it is essential to ensure that risk is aligned with your ability to bear it. Portfolios should prioritize durable returns. In this environment, it is wise to lean on strategies that emphasize known returns—providing that extra edge to navigate potential market shifts.

The information presented in this newsletter is the opinion of Alpha Capital Family Office, LLC and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Alpha Capital Family Office, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.