Services

Your Outsourced Family Office Can Help Manage All Of These Services

Family Office Services

- Family Board Meetings

- Rising Generation Education

- Secure Digital Vault Archive for Family Office Documents

- Strategic Consultation for Purpose, Mission, and Legacy

- Advisor Team Coordination

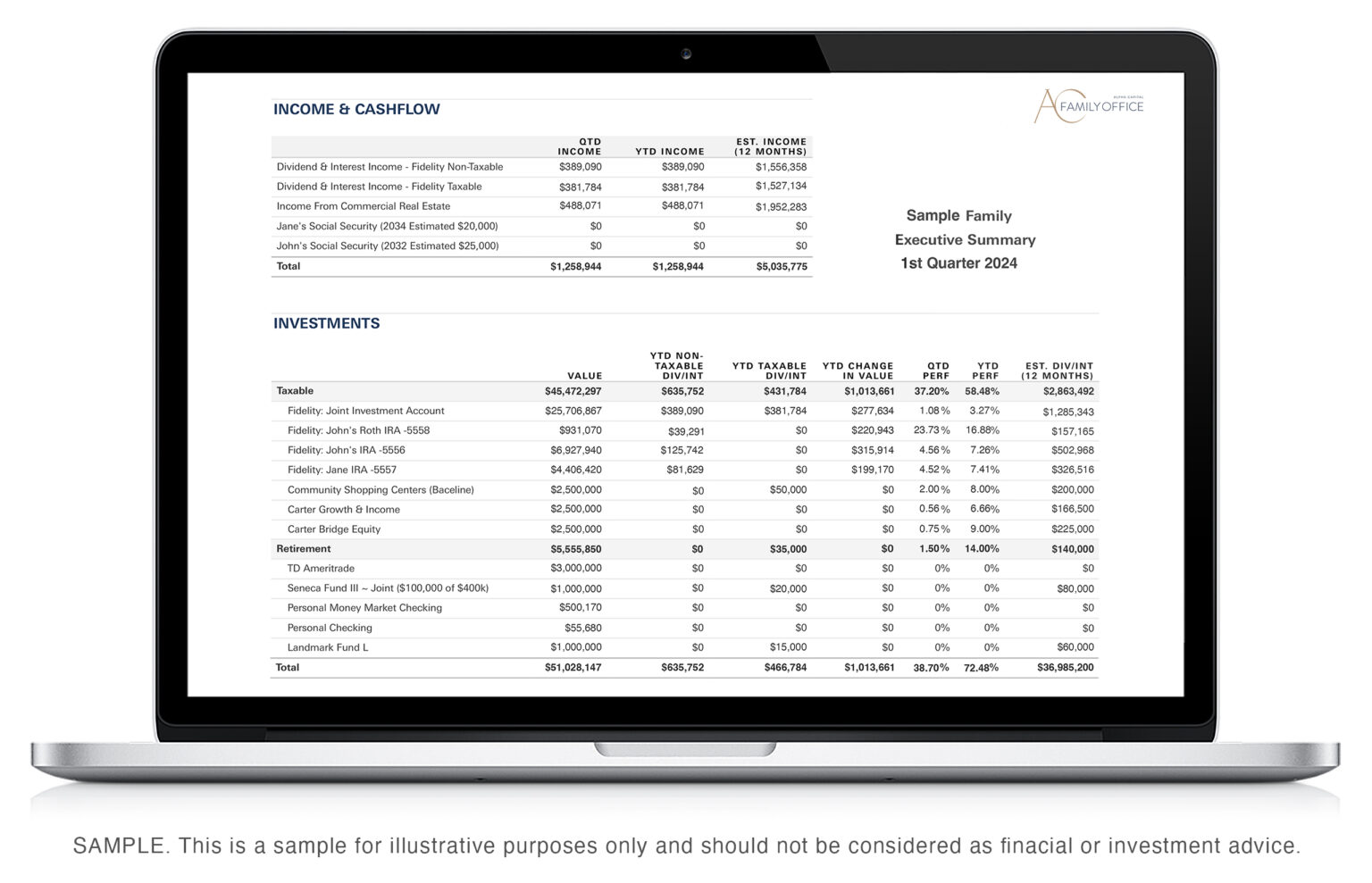

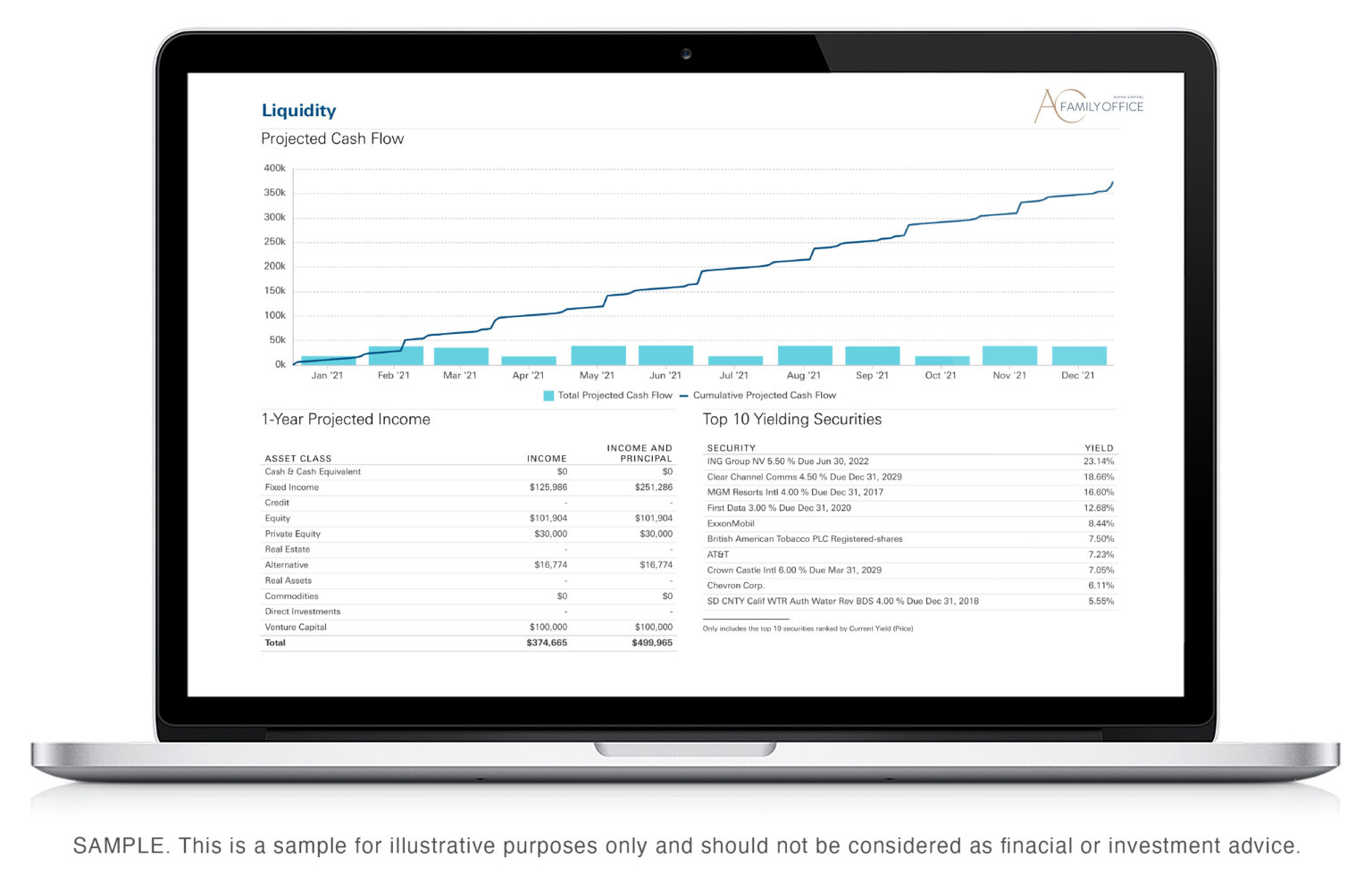

Financial Planning

- Budget Forecasting and Reporting

- Debt Management

- Retirement Planning

- Education Funding

- Return on Assets Analysis

- Proactive Financial Plan Review

Tax Consulting

- Tax Planning Worksheet Advisory

- Proactive Coordination of Quarterly Meetings with Tax Specialists

- Organization of all Annual Tax Filing Documentation and Supporting Information

- Secure Digital Vault Archive for Tax Related Documents

- Entity Structuring and Analysis

- State and Local Tax Nexus Analysis

- Quarterly Estimated Tax Payment Planning

- Tax Payment Coordination

Wealth Transfer Planning

- Estate and Trust Structure Planning

- Annual “State of the Family” Worksheet Creation

- Intra-Family Loan Advisory

- Summary of Legal Documents (Wills, Trusts, etc.)

- Pre-Nuptial and Post-Nuptial Agreement Advisory

- Marital Separation Advisory

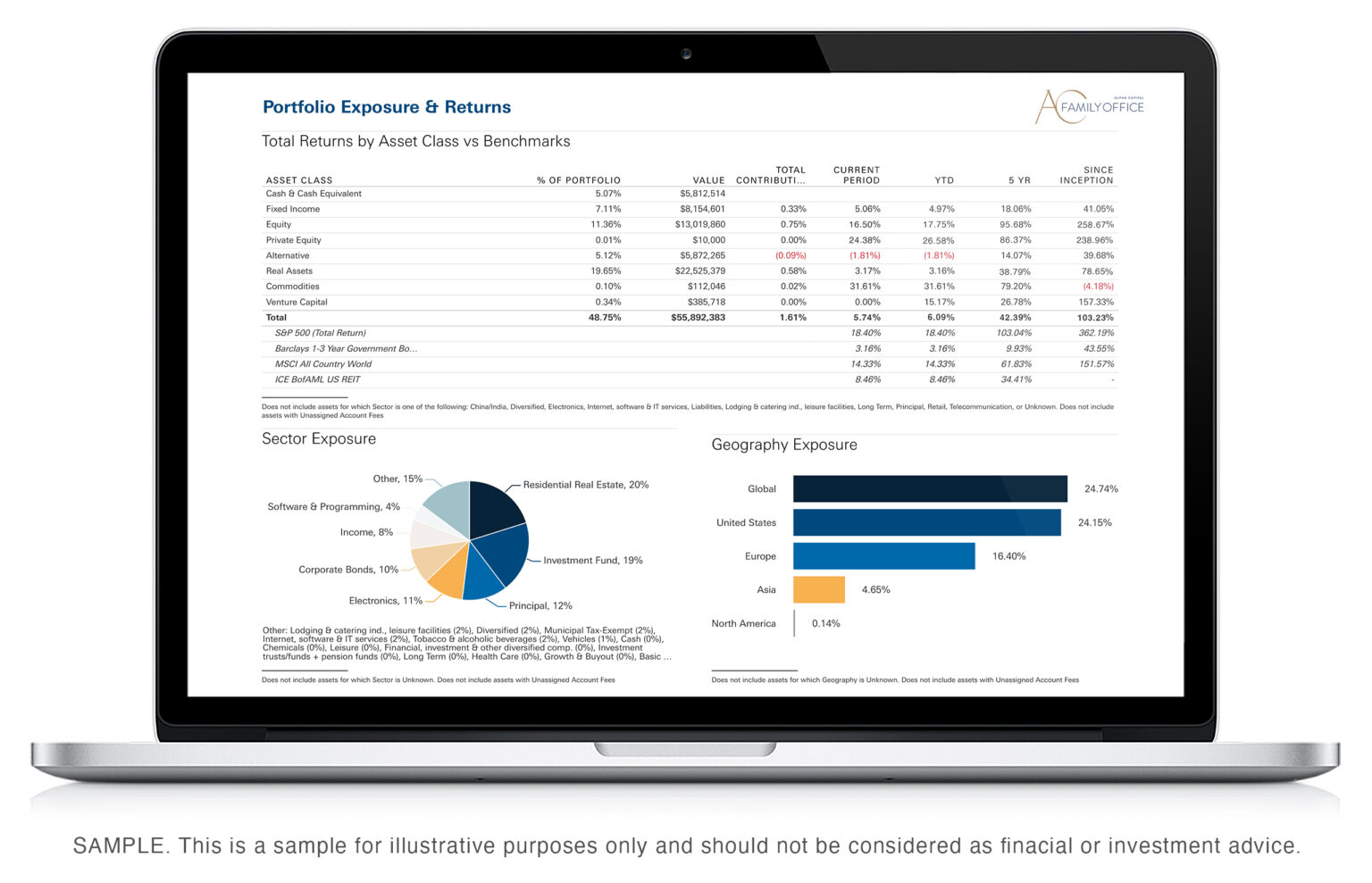

Investment Management

- Investment Policy Statement Creation and Annual Review

- Assets Allocation Modeling

- Investment Manager Research

- Tax Optimized Portfolio Management

- Bespoke Private Investment Opportunity Generation

- Global Macroeconomic and Financial Market Research

- Values Based Screening

- Endowment, Non-Profit, and Foundation Consultation

Bill Pay & Accounting Services

- Balance Sheet and Personal Financial Statement Construction

- Cash Flow and Lifestyle Expense Planning

- General Ledger Reporting

- Full-Service Bookkeeping

- Bill Pay and Invoice Management

Business Consulting

- Business Consulting for Growth and Profitability Optimization

- Business Transition and Succession Planning

- Mergers and Acquisition (“M&A") Planning

- Coordination of Investment Banking and M&A Partners

- Analysis of all Operating and Buy / Sell Agreements

Unforeseen Liability Mitigation

- Comprehensive Risk Management Coordination

- Regular Review of Asset Titling

- Property and Casualty Policy Analysis

- Claims Coordination

- Cyber Security Threat Assessment

- Medical, Life, and Disability Insurance Advisory

Banking Relationship Management & Lending Consultation

- Private Banking Coordination

- Sourcing of Credit Solutions for Personal and Business Needs

- Cash Management Advisory

Philanthropic Advisory

- Strategic Consultation on Design of Purpose, Mission, and Legacy

- Philanthropic Portfolio Asset Allocation Modeling

- Entity Structure Formation Advisory

- Charitable Trust, Private Foundation, and Donor Advised Fund (“DAF”) Administration

- Grant-Making Management and Oversight

- Secure Digital Vault Archive for Philanthropic Documentation and Filings

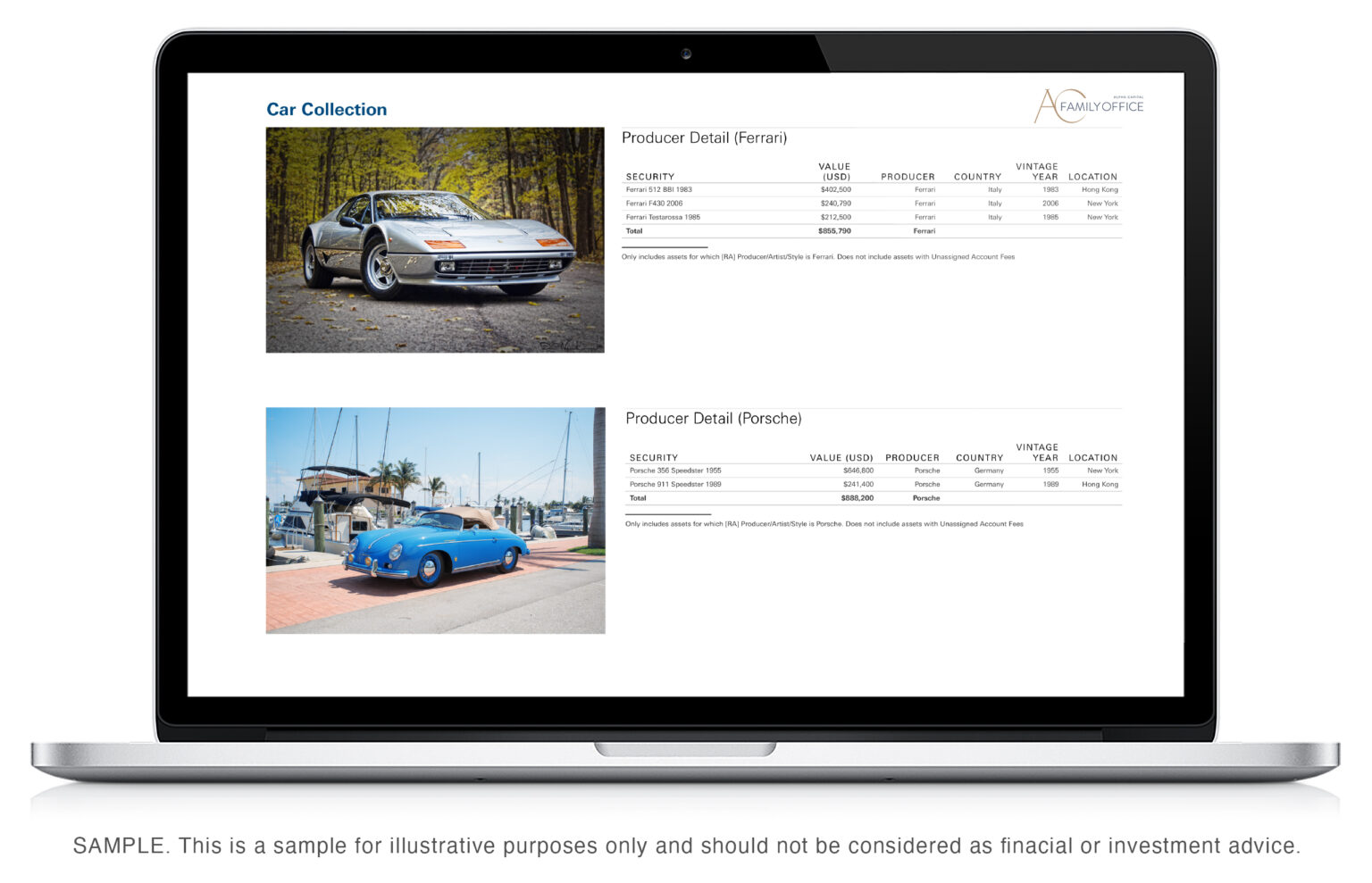

Property & Real Asset Services

- Real Estate and Personal Property Acquisition Advisory

- Primary and Secondary Home, Ranch, and Farm Management

- Aviation, Art, Yacht, and Collectible Acquisition Advisory

- Acquisition Finance Advisory

Fiduciary Services

- Trust Administration and Reporting

- Selection and Training of Trustees and Trust Protectors

- Beneficiary Education

We build a unique team of specialists for each client to create your personalized Family Office. We surround your core team with additional specialists we engage with as your family’s needs grow and change.

Our Technology

Our Process

Discussion and Discovery

Determine Your Goals

Identify Opportunities, Gaps, and Challenges

Explore and Evaluate Options

Refine and Revisit

Let us be your

Financial Quarterback

We can collaborate with your existing professionals or help you build a new team, ensuring efficient discussions, seamless implementation, and cohesive management across all aspects of your financial life.

WHY WORK WITH US

The AC Family Office Difference

A True Fiduciary

We choose to be extremely involved with our clients’ lives, to create purposeful outcomes, and to always be in a position to act as a true fiduciary for them.

Select Clients

We choose to have our clients join an outsourced family office that serves a very limited number of clients so we can dig deep and handle as many needs as those families have, rather than doing a few things for hundreds of clients.

Low Turnover

Like many of our clients, we choose to be entrepreneurial to protect them from excess costs and turnover in the professionals around them at big banks and brokerages.